Is Inflation Eating Your Investment Returns? A Guide to Protecting Your Portfolio

Hey there, fellow investor! Let's talk about something that's probably been on your mind a lot lately – inflation. Remember when a latte cost like, two bucks? Yeah, those were the days! Now, it feels like everything from groceries to gas is costing an arm and a leg. And that, my friends, is inflation in action. It's not just about feeling poorer when you’re at the checkout; it's quietly chipping away at your investment portfolio too.

Think of your investments as a team of little money-making machines. They're supposed to be working hard to grow your wealth, right? But inflation is like a sneaky saboteur, slowing them down and stealing a piece of their profits. It's that invisible force that reduces the purchasing power of your returns. So, even if your portfolio seems to be growing on paper, you might be losing ground in real terms.

Ever notice how the price of your favorite streaming service seems to creep up every year? Or how that new gadget you've been eyeing suddenly seems way more expensive than you remember? That's inflation eroding the value of your money. And if you're not careful, it can seriously derail your long-term financial goals.

But don't panic! This isn't some doomsday prophecy. The good news is that you can take steps to protect your investment portfolio from the ravages of inflation. It's all about understanding how inflation works and making smart choices about where to put your money. Think of it as building a financial fortress to shield your assets from the inflationary storm.

So, how exactly does inflation impact your investments, and what can you do about it? That's what we're going to dive into. Get ready to arm yourself with the knowledge you need to fight back against inflation and keep your investment portfolio thriving. Ready to learn how to become an inflation-fighting ninja? Let's get started!

Understanding the Inflation Beast

Okay, before we jump into specific investment strategies, let's make sure we're all on the same page about what inflation actuallyis. In simple terms, inflation is the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. It's that feeling that your paycheck isn't stretching as far as it used to. Think of it as the silent thief stealing the value of your money.

How Inflation Works: A Quick Rundown

- The Basic Principle: Imagine a world where a loaf of bread costs $1. If inflation is at 5%, that same loaf of bread will cost $1.05 next year. That might not seem like much, but over time, those small increases add up.

- Demand-Pull Inflation: This happens when there's too much money chasing too few goods. Think of it like trying to snag the last slice of pizza at a party. Everyone wants it, so the price goes up.

- Cost-Push Inflation: This occurs when the costs of production increase. For example, if oil prices surge, it becomes more expensive to transport goods, leading to higher prices for consumers.

- The Consumer Price Index (CPI): This is the most widely used measure of inflation. It tracks the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. Keep an eye on the CPI to get a sense of how inflation is trending.

Why Inflation Matters to Investors

Here's the crux of the matter: inflation erodes the real return on your investments. The "real return" is the return you get after accounting for inflation. Let's say your investments earned a 7% return this year, but inflation was 3%. Your real return is only 4%. That 3% difference might not seem huge, but it can significantly impact your long-term wealth.

- Reduced Purchasing Power: Inflation reduces the purchasing power of your investment returns. The same amount of money will buy you less stuff in the future.

- Impact on Fixed-Income Investments: Inflation can be particularly damaging to fixed-income investments like bonds. If inflation rises unexpectedly, the real return on your bonds can plummet.

- Distorted Investment Decisions: Inflation can distort investment decisions by creating a false sense of security. Investors might chase higher returns in riskier assets to keep pace with inflation, which can lead to losses.

Recent Inflation Trends: A Reality Check

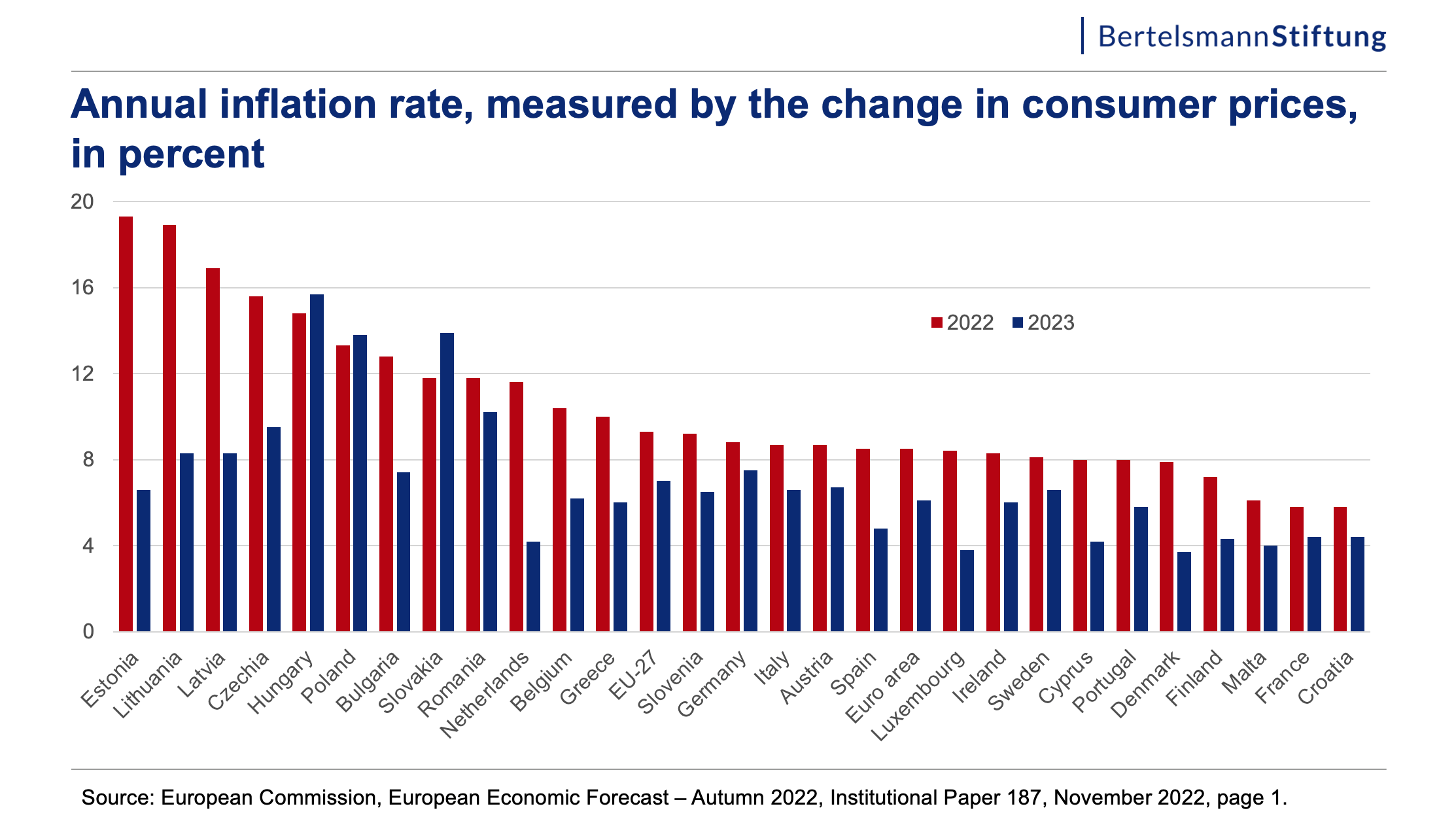

Let's face it, inflation has been making headlines lately. The COVID-19 pandemic, supply chain disruptions, and increased government spending have all contributed to a surge in inflation. As of late 2024, inflation is cooling off from its peaks in 2022 and 2023, but it still remains a concern. It’s important to stay informed about the latest inflation trends to make informed investment decisions. Keep an eye on economic news and reports from organizations like the Bureau of Labor Statistics.

Inflation-Proofing Your Portfolio: Strategies for Success

Alright, now for the good stuff! How do you actually protect your investment portfolio from the clutches of inflation? Here are some strategies to consider:

- Invest in Inflation-Protected Securities: Treasury Inflation-Protected Securities (TIPS) are designed to protect investors from inflation. The principal of TIPS increases with inflation and decreases with deflation, as measured by the Consumer Price Index. When TIPS mature, you are paid the adjusted principal or the original principal, whichever is greater. This is a great way to ensure that your investments keep pace with inflation.

- Diversify into Real Assets: Real assets like real estate, commodities, and precious metals tend to hold their value during inflationary periods. Think about it: people always need housing, and demand for raw materials often increases as prices rise.

- Real Estate: Owning rental properties can provide a steady stream of income that tends to increase with inflation. Plus, the value of real estate itself can appreciate over time.

- Real Estate: Owning rental properties can provide a steady stream of income that tends to increase with inflation. Plus, the value of real estate itself can appreciate over time.

- Commodities: Investing in commodities like oil, gold, and agricultural products can be a good hedge against inflation. These assets tend to rise in price as inflation increases.

- Precious Metals: Gold has long been considered a safe haven during times of economic uncertainty. It tends to maintain its value even when inflation is high.

- Consider Stocks: While stocks can be volatile, they can also provide a good hedge against inflation, especially if you invest in companies with pricing power. These are companies that can pass on rising costs to their customers without losing market share. Look for companies with strong brands and loyal customers.

- Invest in Value Stocks: Value stocks are stocks that are trading at a discount to their intrinsic value. These stocks tend to perform well during inflationary periods because they are less sensitive to changes in interest rates and economic growth.

- Explore International Investments: Diversifying your portfolio internationally can help protect you from inflation in your home country. Different countries have different inflation rates, so investing in a mix of international assets can help you reduce your overall risk.

- Re-evaluate Your Asset Allocation: Your asset allocation should be based on your risk tolerance, time horizon, and financial goals. As your circumstances change, it's important to re-evaluate your asset allocation to make sure it's still appropriate.

- Invest in Short-Term Bonds: While bonds are generally susceptible to inflation, short-term bonds are less sensitive to interest rate hikes that often accompany inflation. Short-term bonds mature quickly, allowing you to reinvest the proceeds at higher interest rates.

- Consider Inflation-Linked Annuities: These annuities provide a guaranteed income stream that increases with inflation. They can be a good option for retirees who want to protect their purchasing power.

- Stay Informed and Adapt: The economic landscape is constantly changing, so it's important to stay informed about the latest trends and adapt your investment strategy accordingly. Keep an eye on inflation data, interest rates, and economic news.

Specific Investments to Consider During Inflation

Let's get down to the nitty-gritty. Here are some specific investments you might want to consider to protect your portfolio from inflation:

- Treasury Inflation-Protected Securities (TIPS): As mentioned earlier, TIPS are a great way to protect your portfolio from inflation. They are issued by the U.S. government and are considered to be very safe. You can buy TIPS directly from the Treasury Department or through a broker.

- Real Estate Investment Trusts (REITs): REITs are companies that own or finance income-producing real estate. They can be a good way to invest in real estate without having to buy and manage properties yourself. REITs tend to perform well during inflationary periods because rents typically increase with inflation.

- Master Limited Partnerships (MLPs): MLPs are publicly traded partnerships that own and operate energy infrastructure assets, such as pipelines and storage facilities. They tend to generate stable cash flows and pay high dividends, which can help protect your portfolio from inflation.

- Gold Exchange-Traded Funds (ETFs): Gold ETFs allow you to invest in gold without having to buy and store physical gold. They can be a good way to diversify your portfolio and protect it from inflation.

- Commodity Index Funds: Commodity index funds track the performance of a basket of commodities, such as oil, gold, and agricultural products. They can be a good way to diversify your portfolio and protect it from inflation.

Managing Debt During Inflation

Inflation doesn't just affect your investments; it also affects your debt. Here's how to manage your debt during inflationary times:

- Fixed-Rate Debt is Your Friend: If you have fixed-rate debt, such as a mortgage or a student loan, you're in luck! Inflation erodes the real value of your debt, making it easier to pay off. Your payments stay the same, but your income may increase with inflation.

- Variable-Rate Debt is a Risk: Variable-rate debt, such as credit card debt, can become more expensive during inflationary periods. Interest rates tend to rise as inflation increases, which means your payments will go up.

- Prioritize Paying Down Debt: If you have variable-rate debt, prioritize paying it down as quickly as possible. The sooner you pay it off, the less you'll have to worry about rising interest rates.

- Consider Refinancing: If you have a high-interest loan, consider refinancing it to a lower interest rate. This can save you money and make your debt more manageable.

Expert Insights and Predictions

What do the experts say about inflation and investing? Here's a glimpse into some expert perspectives and predictions:

- Diversification is Key: Most experts agree that diversification is the best way to protect your portfolio from inflation. Don't put all your eggs in one basket. Spread your investments across different asset classes and sectors.

- Focus on Long-Term Growth: While it's important to protect your portfolio from inflation, don't lose sight of your long-term goals. Focus on investing in companies with strong growth potential.

- Be Prepared for Volatility: Inflation can lead to increased market volatility. Be prepared for ups and downs and don't panic sell during market downturns.

- Stay Flexible: The economic landscape is constantly changing, so it's important to stay flexible and adapt your investment strategy as needed.

Examples of How Inflation Has Impacted Investments in the Past

History often repeats itself. Looking at past inflationary periods can provide valuable insights into how to invest during times of rising prices:

- The 1970s: The 1970s were a period of high inflation. During this time, real estate, commodities, and precious metals performed well, while stocks and bonds struggled.

- The 2000s: The early 2000s also saw a period of rising inflation. During this time, commodities and emerging markets performed well.

- Lessons Learned: These historical examples highlight the importance of diversification and investing in real assets during inflationary periods.

Monitoring Your Portfolio During Inflation

Protecting your portfolio from inflation isn't a one-time task. It's an ongoing process that requires regular monitoring and adjustments. Here's how to monitor your portfolio during inflationary times:

- Track Inflation Data: Keep an eye on the Consumer Price Index (CPI) and other inflation indicators. This will give you a sense of how inflation is trending and whether you need to make any adjustments to your portfolio.

- Review Your Asset Allocation: Regularly review your asset allocation to make sure it's still appropriate for your risk tolerance, time horizon, and financial goals.

- Rebalance Your Portfolio: Rebalance your portfolio periodically to maintain your desired asset allocation. This involves selling some assets that have performed well and buying assets that have underperformed.

- Consult with a Financial Advisor: Consider consulting with a financial advisor who can help you develop a personalized investment strategy that takes inflation into account.

Questions and Answers About Inflation and Investing

Q: Will inflation last forever?

A: No one has a crystal ball, but most economists believe that inflation is likely to moderate over time. However, it's important to be prepared for the possibility of sustained inflation.

Q: Is it too late to protect my portfolio from inflation?

A: It's never too late to take steps to protect your portfolio from inflation. Even if inflation has already started to rise, there are still things you can do to mitigate its impact.

Q: Should I sell all my stocks and invest in gold?

A: No, that's not a good idea. Selling all your stocks and investing in gold would be a very risky move. Diversification is key. You should have a mix of different asset classes in your portfolio.

Q: How much of my portfolio should I allocate to inflation-protected assets?

A: The amount you should allocate to inflation-protected assets depends on your risk tolerance, time horizon, and financial goals. A financial advisor can help you determine the right allocation for your situation.

In conclusion, navigating the world of investing during inflationary times can feel like traversing a financial minefield. However, with the right knowledge and strategies, you can protect your portfolio and keep your financial goals on track. We've covered everything from understanding the basics of inflation to specific investment strategies and tips for managing debt. Remember, diversification is your best friend, and staying informed is crucial.

Now, it's time to take action. Review your investment portfolio, assess your risk tolerance, and consider implementing some of the strategies we've discussed. Don't wait for inflation to erode your hard-earned savings. Take control of your financial future today.

The journey to financial security is a marathon, not a sprint. Stay focused, stay informed, and never stop learning. Are you ready to take the first step towards inflation-proofing your portfolio? Go forth and conquer!