Decoding Crypto Dreams: Foolproof ICO Analysis to Dodge the Duds

Hey there, crypto adventurers! Ever felt like you're staring into a crystal ball trying to predict which ICO is going to be the next Bitcoin and which one is destined for the crypto graveyard? You're not alone. Investing in Initial Coin Offerings (ICOs) can feel like navigating a minefield blindfolded. One wrong step andboom, your hard-earned crypto vanishes into thin air.

Think of it like this: imagine you're at a bustling farmers market. Each stall represents a new ICO, promising fresh, organic, life-changing… well, crypto. Some stalls are overflowing with vibrant produce, buzzing with enthusiastic customers, and radiating an aura of genuine quality. Others? They're kinda… sad. Wilted lettuce, suspiciously quiet vendors, and a general vibe that screams "avoid at all costs."

The problem is, in the fast-paced world of ICOs, it’s not always easy to tell the difference between the plump, juicy crypto tomatoes and the rotten ones lurking beneath the surface. The internet is flooded with hype, flashy websites, and promises of untold riches. It’s designed to make you FOMO (Fear Of Missing Out) your way into investing before you’ve had a chance to think. Trust me, we’ve all been there.

And that's where this guide comes in. We're not promising to give you a magic formula to predict the future of crypto. Nobody can do that! What wecando is equip you with the tools and knowledge you need to analyze ICOs like a seasoned pro. We'll break down the key strategies that can help you separate the wheat from the chaff, the potential unicorns from the inevitable flops. We'll show you how to understand the risks involved (because, let’s be real, they’re significant) and make informed decisions that protect your investment.

Forget blindly throwing money at the latest hyped-up project. We're going to dive deep into the nitty-gritty of ICO analysis, covering everything from whitepaper dissection to team evaluation to community sentiment analysis. We'll explore real-world case studies, examine current market trends, and even venture a few realistic predictions (with a healthy dose of skepticism, of course).

So, buckle up, friends. Grab your favorite beverage (crypto-themed cocktail, anyone?), and let's embark on this journey together. Are you ready to learn the secrets to spotting the next big thing in the world of ICOs, and more importantly, how to avoid getting burned in the process? Let's get started!

Essential ICO Analysis Strategies

Okay, friends, let's get down to brass tacks. You're here because you want to make smarter ICO investments, not because you enjoy losing money (we hope!). So, let's dive into some crucial analysis strategies that will help you navigate the sometimes murky waters of initial coin offerings.

• The Whitepaper Deep Dive: Your First Line of Defense

Think of the whitepaper as the ICO's business plan, technical manual, and marketing pitch all rolled into one. It's the first place you should look, and you should treat it like your new best friend (or maybe a really important homework assignment). Don't just skim it! Read it carefully, critically, and repeatedly. Here’s what you should be looking for:

Clarity and Conciseness: Is the whitepaper easy to understand? Does it clearly explain the project's goals, technology, and implementation plan? If it's full of jargon and vague promises, that's a red flag. A legitimate project will be able to articulate its vision in a way that anyone can grasp.

Problem and Solution: Does the whitepaper identify a real problem? Does the proposed solution actually solve that problem? This is crucial! Many ICOs are just solutions looking for a problem. Look for concrete examples and realistic scenarios.

Technical Details: How does the technology work? Is it innovative, or is it just a rehash of existing concepts? Look for explanations of the underlying algorithms, consensus mechanisms, and security protocols. If the whitepaper glosses over these details, be wary. If they are Open Source, then you can view the code and see the commits that the developer has made.

Tokenomics: How will the tokens be distributed? What is the total supply? What are the use cases for the token? A well-designed tokenomics model is essential for the long-term success of the project. Watch out for overly inflationary models or schemes where a small group of insiders controls a large percentage of the tokens. Read up on cliff and vesting schedules!

Roadmap: Does the whitepaper outline a clear roadmap with realistic milestones? Does the team have a proven track record of meeting deadlines? A detailed and achievable roadmap demonstrates that the team has a plan and is committed to executing it. Look for realistic projections, not pie-in-the-sky promises.

Real-World Example: Let's say you're looking at an ICO for a decentralized social media platform. The whitepaper should clearly explain how the platform will address issues like censorship, data privacy, and content moderation. It should also detail the technical architecture of the platform and the role of the token within the ecosystem.

• Team Transparency and Credibility: Know Who You're Trusting

Behind every successful ICO is a team of talented and dedicated individuals. But how do you know if the team is legit? Here's what to look for:

Experience and Expertise: Does the team have the necessary experience and expertise to execute the project? Look for individuals with backgrounds in blockchain technology, software development, marketing, and business development. Check their Linked In profiles and verify their credentials. Are they real people?

Advisory Board: Does the project have a strong advisory board? Advisors can provide valuable guidance and support to the team. Look for advisors with relevant experience and a proven track record of success.

Transparency: Is the team transparent about their identities and backgrounds? Are they willing to engage with the community and answer questions? Anonymous teams are a major red flag. Consider looking at their Git Hub and see the quality of the commits that the developers have made, as well as the consistency.

Public Presence: Do the team members actively participate in industry events and online forums? Are they willing to put themselves out there and defend their project? A team that is confident and transparent is more likely to be successful.

Real-World Example: Imagine you're considering investing in an ICO for a new De Fi protocol. Check the team's Linked In profiles to see if they have experience in finance, blockchain development, or cryptography. Look for evidence that they have worked on successful projects in the past. If the team is anonymous or lacks relevant experience, proceed with caution.

• Community Engagement and Sentiment: Listen to the Crowd (But Don't Blindly Follow)

A strong and engaged community is a vital indicator of an ICO's potential. A vibrant community will actively participate in discussions, provide feedback, and support the project. However, it's important to remember that community sentiment can be manipulated, so take it with a grain of salt.

Social Media Presence: Is the ICO active on social media platforms like Twitter, Telegram, and Reddit? Is the community engaged and supportive? Are the team members responsive to questions and concerns?

Online Forums and Discussion Boards: What are people saying about the ICO in online forums and discussion boards? Are there any red flags or concerns being raised? Pay attention to both positive and negative feedback.

Sentiment Analysis Tools: Use sentiment analysis tools to gauge the overall sentiment towards the ICO. These tools can analyze social media posts and online articles to determine whether the general perception is positive, negative, or neutral.

Beware of Fake Communities: Be wary of ICOs with suspiciously large or overly enthusiastic communities. These communities may be composed of bots or paid shills designed to artificially inflate demand. Look for genuine engagement and meaningful discussions.

Real-World Example: Suppose you're evaluating an ICO for a new gaming platform. Check the project's Telegram group and see how active the community is. Are people asking questions and providing feedback? Are the team members responsive and helpful? If the Telegram group is filled with spam or bots, that's a red flag.

• Token Utility and Value Proposition: Does the Token Have a Purpose?

One of the most important factors to consider is the utility of the token. What purpose does the token serve within the ecosystem? Does it provide access to exclusive features, reward users for participation, or govern the protocol?

Use Cases: Are there clear and compelling use cases for the token? Does the token have a real-world application, or is it just a speculative asset?

Demand and Supply: What is the supply of the token, and what factors will influence its demand? A well-designed tokenomics model should ensure that demand for the token exceeds supply, driving up its value over time.

Token Burn Mechanisms: Does the project have any token burn mechanisms in place to reduce the supply of tokens over time? Token burns can help to increase the scarcity and value of the remaining tokens.

Staking and Governance: Can token holders stake their tokens to earn rewards or participate in governance decisions? Staking and governance mechanisms can help to incentivize long-term holding and participation in the ecosystem.

Real-World Example: Consider an ICO for a decentralized data storage network. The token could be used to pay for storage space, reward users for contributing storage capacity, and govern the network's parameters. The more people use the network, the greater the demand for the token, and the higher its value.

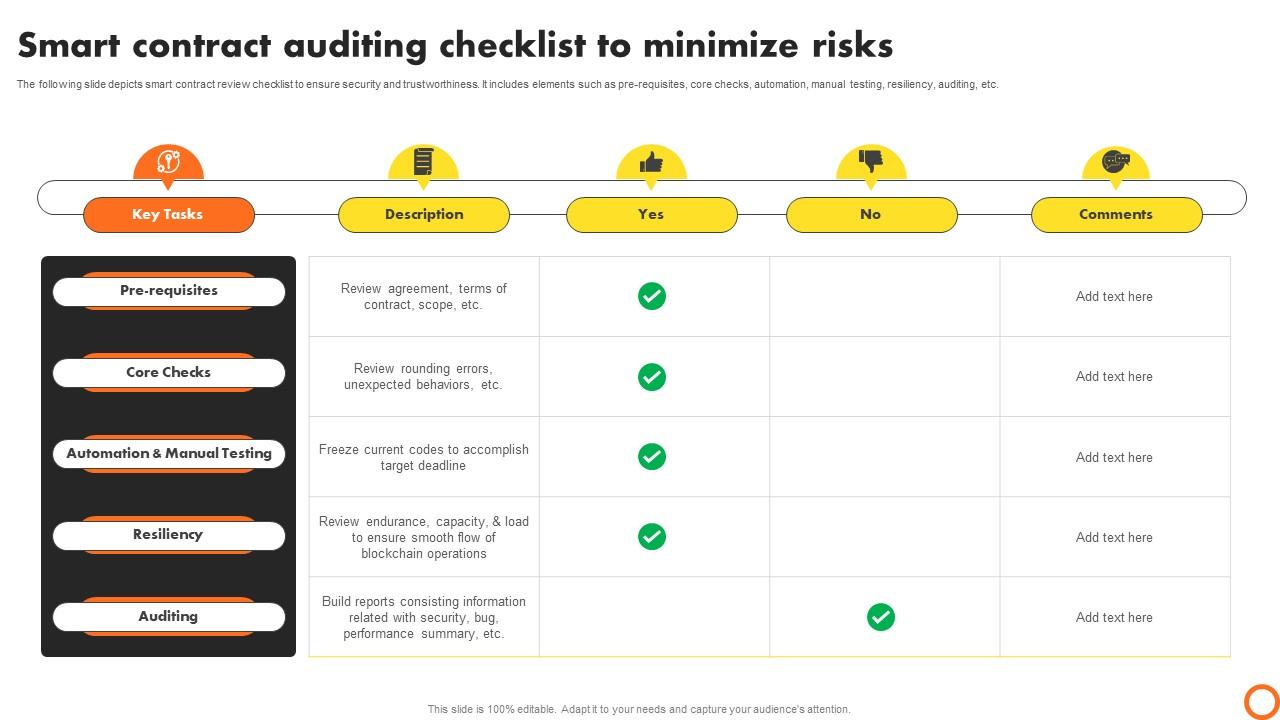

• Security Audits and Code Review: Is the Code Secure?

Security is paramount in the world of cryptocurrency. Before investing in an ICO, make sure that the project's code has been thoroughly audited by a reputable security firm. A security audit can identify potential vulnerabilities and ensure that the code is secure from attacks.

Third-Party Audits: Has the project undergone a third-party security audit? Look for audits from reputable firms with experience in blockchain security.

Open Source Code: Is the project's code open source? Open source code allows anyone to review the code and identify potential vulnerabilities. This is a good sign that the project is transparent and committed to security.

Bug Bounty Programs: Does the project have a bug bounty program in place? Bug bounty programs incentivize security researchers to find and report vulnerabilities in the code.

Past Security Breaches: Has the project experienced any security breaches in the past? If so, what steps have they taken to address the vulnerabilities?

Real-World Example: Let's say you're considering investing in an ICO for a new decentralized exchange. Before investing, check to see if the exchange's code has been audited by a reputable security firm. Look for evidence that the audit has identified and addressed any potential vulnerabilities. Without a security audit, you're essentially trusting that the developers haven't made any mistakes, which is a risky proposition.

• Legal and Regulatory Compliance: Are They Playing by the Rules?

The legal and regulatory landscape for ICOs is constantly evolving. Before investing in an ICO, make sure that the project is compliant with all applicable laws and regulations.

Jurisdiction: Where is the project based? Different jurisdictions have different regulations regarding ICOs.

Securities Laws: Is the token considered a security under applicable securities laws? If so, the project may need to register with regulatory authorities and comply with strict disclosure requirements.

KYC/AML Compliance: Does the project comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations? KYC/AML compliance is essential for preventing fraud and money laundering.

Legal Opinion: Has the project obtained a legal opinion from a qualified attorney regarding the legality of the ICO?

Real-World Example: Suppose you're looking at an ICO for a new stablecoin. Make sure that the project is compliant with all applicable regulations regarding stablecoins, such as those issued by regulatory authorities like the SEC in the United States or the Financial Conduct Authority (FCA) in the United Kingdom. Failure to comply with these regulations could result in legal action and the loss of your investment.

Questions and Answers about ICOs

Let's tackle some common questions about ICOs and how to analyze them effectively.

Q: What's the biggest mistake people make when investing in ICOs?

A: Jumping in based on hype without doing their own research. It's easy to get caught up in the excitement of a new project, but it's crucial to take the time to thoroughly analyze the ICO and understand the risks involved. Blindly following the crowd is a recipe for disaster.

Q: How can I spot a potential scam ICO?

A: Look for red flags like an anonymous team, unrealistic promises, a poorly written whitepaper, a lack of community engagement, and a sense of urgency to invest. If something seems too good to be true, it probably is.

Q: What are the best resources for researching ICOs?

A: There are many websites and online communities that provide information and analysis on ICOs. Some popular resources include Coin Market Cap, Coin Gecko, ICO Drops, and various cryptocurrency forums and subreddits. However, always remember to do your own research and not rely solely on the opinions of others.

Q: Is it still worth investing in ICOs in 2024?

A: ICOs can still offer opportunities for high returns, but they also come with significant risks. The key is to be selective and invest only in projects that have a solid foundation, a strong team, and a clear value proposition. Diversification is also important to mitigate risk.

Final Thoughts: Your Crypto Compass

Alright, friends, we've covered a lot of ground in this guide. From dissecting whitepapers to scrutinizing teams to analyzing community sentiment, you're now equipped with the knowledge and tools to approach ICOs with a critical eye. Remember, investing in ICOs is not a get-rich-quick scheme. It's a high-risk, high-reward endeavor that requires careful research, due diligence, and a healthy dose of skepticism.

The core takeaway here is that informed decisions are your best defense against the scams and failures that plague the ICO landscape. Don't let FOMO cloud your judgment. Take your time, do your homework, and only invest what you can afford to lose. The cryptocurrency market is volatile, and ICOs are even more so.

Now, it's time to put your newfound knowledge into action. Start researching potential ICOs, apply the strategies we've discussed, and make informed decisions that align with your investment goals. Don't be afraid to ask questions, seek out expert opinions, and challenge the hype. The more you learn, the better equipped you'll be to navigate the exciting (and sometimes treacherous) world of ICOs.

So, what are you waiting for? Dive into the world of ICO analysis, start researching, and remember to stay safe and informed. And hey, maybe you'll be the one to discover the next crypto unicorn! The future of crypto is waiting, and with the right tools and knowledge, you can be a part of it.

Now go forth and analyze! What are some ICOs you're currently researching, and what are your initial thoughts?