Step One: Title

Yield Farming Success: Your Confident Start in De Fi.

Step Two: Opening

Hey there, future De Fi maestros! Ever felt like your crypto was just sitting there, gathering digital dust in your wallet? We've all been there. It's like having a high-performance sports car and only using it to drive to the grocery store. Talk about wasted potential! But what if I told you there's a way to put those assets to work, turning them into little yield-generating machines? That's where yield farming comes in, and trust me, it’s a whole lot more exciting than watching paint dry.

Unlocking the Secrets to Lucrative Yield Farming

Imagine this: you're at a digital farmer's market, not selling tomatoes or cucumbers, but swapping and lending crypto to earn rewards. These rewards come in the form of more crypto, sweetening the deal. Think of it as a crypto savings account on steroids, but with a few more twists and turns. Now, I know what you're thinking: "Sounds complicated!" And yes, it can be. But fear not! We're here to break down the basics, explore advanced strategies, and equip you with the knowledge to navigate the yield farming landscape with confidence. Whether you're a seasoned De Fi veteran or just dipping your toes into the crypto pool, this guide is your roadmap to successful yield farming. Are you ready to transform your idle crypto into a thriving digital harvest? Let's dive in!

Step Three: Article Body

So, you're intrigued by the world of yield farming but maybe a little overwhelmed? Don't worry; it's like learning a new language. It might sound like gibberish at first, but with practice and the right resources, you'll be fluent in no time. Let's break down some yield farming strategies that actually work and give you the confidence to get started.

Understanding the Risks Before You Dive In

Before we jump into the exciting world of yield farming strategies, it's crucial to understand the inherent risks. Remember, with great potential rewards comes great responsibility (and potential pitfalls!). Ignoring these risks is like driving a race car without brakes – thrilling, perhaps, but ultimately a recipe for disaster.

- Impermanent Loss: This is the boogeyman of liquidity providers (LPs). Imagine you deposit ETH and another token into a liquidity pool. If the price of ETH significantly changes compared to the other token, you might end up with less dollar value than if you had simply held your tokens. Think of it like this: the pool wants to maintain a 50/50 balance of value. So, if ETH goes way up, it will sell some ETH and buy the other token to rebalance. When you withdraw, you might get back fewer ETH and more of the other token than you initially deposited. It's not always a "loss," but it's often less profit than simply holding.

- Smart Contract Risk: De Fi platforms rely on smart contracts, which are essentially lines of code that execute transactions automatically. However, code can have bugs. If a smart contract has a vulnerability, hackers can exploit it and steal funds from the platform. Always choose platforms with a proven track record and that have undergone rigorous security audits. Think of it as choosing a bank – you wouldn't put your money in a bank that's known for getting robbed, right?

- Rug Pulls: This is a particularly nasty scam in the De Fi world. A rug pull happens when the developers of a project abandon it, often after luring in investors with high yields. They essentially "pull the rug" out from under the investors, leaving them with worthless tokens. Do your research! Look for projects with transparent teams, active communities, and a real use case beyond just offering high APYs.

- Volatility: The crypto market is known for its volatility. The value of the tokens you're farming can fluctuate wildly, impacting your returns. What looks like a lucrative yield today might be significantly less tomorrow. Be prepared for price swings and don't invest more than you can afford to lose.

- Complexity: Yield farming can be complex, involving multiple platforms, strategies, and token types. It's easy to make mistakes, such as sending tokens to the wrong address or miscalculating your returns. Take your time, double-check everything, and start small.

Conservative Strategies: Low Risk, Lower Reward

Okay, so you're a bit risk-averse? That's totally fine! There are plenty of yield farming strategies that prioritize safety over sky-high returns. Think of these as the "bond investments" of the De Fi world – steady, reliable, and less likely to keep you up at night.

- Stablecoin Farming: This is often the entry point for new yield farmers. Stablecoins (like USDT, USDC, and DAI) are cryptocurrencies pegged to a stable asset, usually the US dollar. This means their price is relatively stable, reducing the risk of impermanent loss. You can deposit stablecoins into platforms like Aave, Compound, or Curve to earn interest. While the APYs are typically lower than with more volatile tokens, the risk is also significantly reduced. It's like parking your money in a high-yield savings account – not going to make you rich overnight, but a safe and reliable way to earn some extra income.

- Single-Sided Staking: Some platforms allow you to stake a single token to earn rewards. This eliminates the risk of impermanent loss, as you're not providing liquidity in a pair. For example, you might be able to stake CAKE (the native token of Pancake Swap) to earn more CAKE. The returns might not be astronomical, but it's a simple and straightforward way to earn passive income.

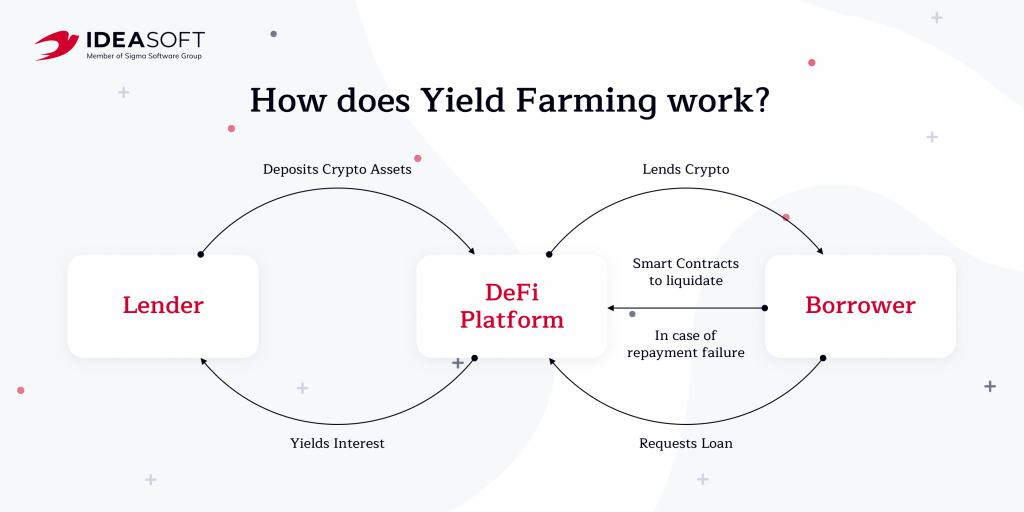

- Lending on Established Platforms: Lending your crypto on well-established platforms like Aave or Compound can be a relatively safe way to earn yield. These platforms have been around for a while, have a proven track record, and have undergone multiple security audits. You're essentially lending your crypto to borrowers and earning interest on the loan. The APYs might not be as high as with other strategies, but the risk is generally lower.

Moderate Strategies: Balancing Risk and Reward

Ready to take things up a notch? These strategies offer a good balance between risk and reward, allowing you to potentially earn higher yields without exposing yourself to excessive risk. Think of these as the "blue-chip stocks" of the De Fi world – established, reliable, and with good growth potential.

- Providing Liquidity in Stablecoin Pools: While providing liquidity in general carries the risk of impermanent loss, providing liquidity in stablecoin pools can mitigate this risk. Since stablecoins are pegged to a stable asset, their price fluctuations are minimal, reducing the likelihood of significant impermanent loss. Platforms like Curve specialize in stablecoin swaps and offer attractive yields for liquidity providers.

- Farming with LP Tokens on Reputable Platforms: Once you've provided liquidity to a pool, you'll receive LP tokens representing your share of the pool. You can then stake these LP tokens on the same platform or another platform to earn even more rewards. This is known as "LP token farming." By sticking to reputable platforms with a proven track record, you can reduce the risk of rug pulls and smart contract vulnerabilities.

- Delta-Neutral Strategies: These are more advanced strategies that aim to hedge against price fluctuations and minimize the impact of impermanent loss. They typically involve taking offsetting positions in different markets to create a "delta-neutral" portfolio, meaning that the overall value of the portfolio is relatively unaffected by price movements. These strategies can be complex and require a good understanding of De Fi markets, but they can also offer attractive risk-adjusted returns.

Advanced Strategies: High Risk, High Reward (Handle with Care!)

Okay, thrill-seekers, this section is for you! These strategies offer the potential for massive returns, but they also come with significant risks. Proceed with caution and only invest what you can afford to lose. Think of these as the "venture capital" of the De Fi world – high risk, high reward, and potentially a wild ride.

- Leveraged Yield Farming: This involves borrowing funds to increase your position in a yield farm. This can amplify your returns, but it also amplifies your losses. If the price of the tokens you're farming goes down, you could be liquidated and lose your entire investment. Proceed with extreme caution and only use leverage if you fully understand the risks involved. It's like using a chainsaw – incredibly powerful, but dangerous if you don't know what you're doing.

- Farming on New and Unaudited Platforms: New De Fi platforms often offer incredibly high APYs to attract users. However, these platforms are also more likely to have vulnerabilities and could be rug pulled. Farming on these platforms is like playing the lottery – you might win big, but the odds are stacked against you.

- Cross-Chain Farming: This involves moving your tokens across different blockchains to participate in yield farms on other networks. This can be complex and requires bridging protocols, which can have their own vulnerabilities. Furthermore, cross-chain transactions can be slow and expensive. Only attempt this if you're comfortable with the technical aspects and understand the risks involved.

Tools and Resources for Successful Yield Farming

Navigating the world of yield farming can be daunting, but thankfully, there are plenty of tools and resources available to help you succeed. Here are a few of my favorites:

- De Fi Pulse: This website tracks the total value locked (TVL) in various De Fi protocols, giving you an overview of the most popular and trusted platforms.

- Coin Gecko and Coin Market Cap: These websites provide information on the prices, market caps, and trading volumes of various cryptocurrencies, helping you to make informed investment decisions.

- De Fi Llama: This platform offers comprehensive data on various De Fi protocols, including their APYs, TVL, and tokenomics.

- Etherscan and Bsc Scan: These are block explorers that allow you to view transactions, smart contracts, and other data on the Ethereum and Binance Smart Chain blockchains.

- Twitter and Discord: These platforms are great for staying up-to-date on the latest De Fi news and trends and for connecting with other yield farmers.

Remember to Do Your Own Research (DYOR)!

This is perhaps the most important piece of advice I can give you. Before investing in any yield farm, always do your own research. Don't just blindly follow the hype or listen to what others are saying. Read the project's whitepaper, understand the tokenomics, and assess the risks involved. The De Fi world is constantly evolving, so it's important to stay informed and make your own decisions.

Step Four: Questions and Answers

Got some burning questions about yield farming? Let's tackle a few of the most common ones:

- What is impermanent loss, and how can I avoid it? Impermanent loss happens when the price ratio of tokens you've provided to a liquidity pool changes, potentially reducing your returns compared to simply holding those tokens. To minimize it, choose pools with stablecoin pairs or tokens with similar price movements, or consider delta-neutral strategies.

- How do I choose a safe and reputable yield farming platform? Look for platforms with a long track record, high TVL (Total Value Locked), and a strong reputation for security. Check for security audits conducted by reputable firms and read reviews from other users. Don't blindly trust platforms offering unbelievably high APYs.

- What are LP tokens, and how do I use them? LP (Liquidity Provider) tokens represent your share of a liquidity pool. When you deposit tokens into a pool, you receive LP tokens in return. You can then stake these LP tokens on the platform (or another platform) to earn additional rewards.

- How much money do I need to start yield farming? You can start with as little as a few dollars, but keep in mind that gas fees (transaction costs) can eat into your profits, especially on the Ethereum network. Consider starting with a larger amount or using platforms on Layer-2 solutions or other blockchains with lower fees.

Step Five: Closing

So, there you have it: a comprehensive guide to yield farming strategies that work. We've covered everything from the basics of risk management to advanced techniques for maximizing your returns. Remember, yield farming is not a "get rich quick" scheme. It requires careful research, diligent monitoring, and a willingness to learn and adapt. But with the right knowledge and a bit of patience, you can unlock the potential of your crypto assets and generate passive income in the exciting world of De Fi.

Now, it's your turn to take action! Start by researching different yield farming platforms and strategies. Experiment with small amounts of capital and gradually increase your position as you gain confidence. Join online communities and connect with other yield farmers to share knowledge and learn from their experiences. And most importantly, never stop learning!

The world of De Fi is constantly evolving, and new opportunities are emerging all the time. By staying informed and adaptable, you can stay ahead of the curve and continue to generate lucrative yields for years to come. So, go out there and start farming, friends! Your digital harvest awaits. Are you ready to reap the rewards?