Step One:

Navigating the Tightrope: Mastering the Art of Risk and Reward in Investing.

Step Two:

Hey there, fellow investors! Ever feel like you're walking a tightrope, juggling dreams of financial freedom with the very real fear of losing your shirt? You're not alone. Investing can feel like that, especially when you're trying to understand the delicate dance between risk and reward. It’s like trying to bake a cake – too much sugar, and it's sickly sweet; too little, and it's bland. Same with investing; too much risk, and you might face big losses; too little, and your returns will be as exciting as watching paint dry.

Think about it this way: remember that time you bet your friend that your favorite football team would win? The potential reward was bragging rights and maybe a free pizza. But the risk? The sting of defeat and having to buy the pizza. That's risk and reward in a nutshell, only with bigger numbers and potentially more serious consequences.

The thing is, everyone's risk tolerance is different. What keeps one person up at night might not even register on another's radar. Imagine your super-cautious Aunt Mildred investing in meme stocks – terrifying, right? And on the flip side, imagine your thrill-seeking cousin, who skydives for fun, only investing in government bonds. Sounds pretty boring for him, doesn’t it?

And here's a little secret: even seasoned investors get it wrong sometimes. We see the headlines: tech giants stumbling, market crashes sending shivers down spines. Even the smartest minds can't predict the future with 100% accuracy. But what separates the successful investors from the rest is their ability to understand, assess, and manage risk while aiming for suitable returns.

Now, have you ever wondered how to actuallyquantifyrisk? Or how to find that sweet spot where the potential reward outweighs the potential pitfalls? Stick around, because we’re about to dive deep into the fascinating world of risk and reward, demystifying the jargon and giving you the tools you need to make smarter investment decisions. We're going to explore everything from understanding your own risk tolerance to analyzing different investment options. So, grab a cup of coffee, settle in, and let's unravel the mysteries of the market together. Ready to learn how to navigate the tightrope like a pro?

Step Three:

Understanding Risk and Reward in Investing

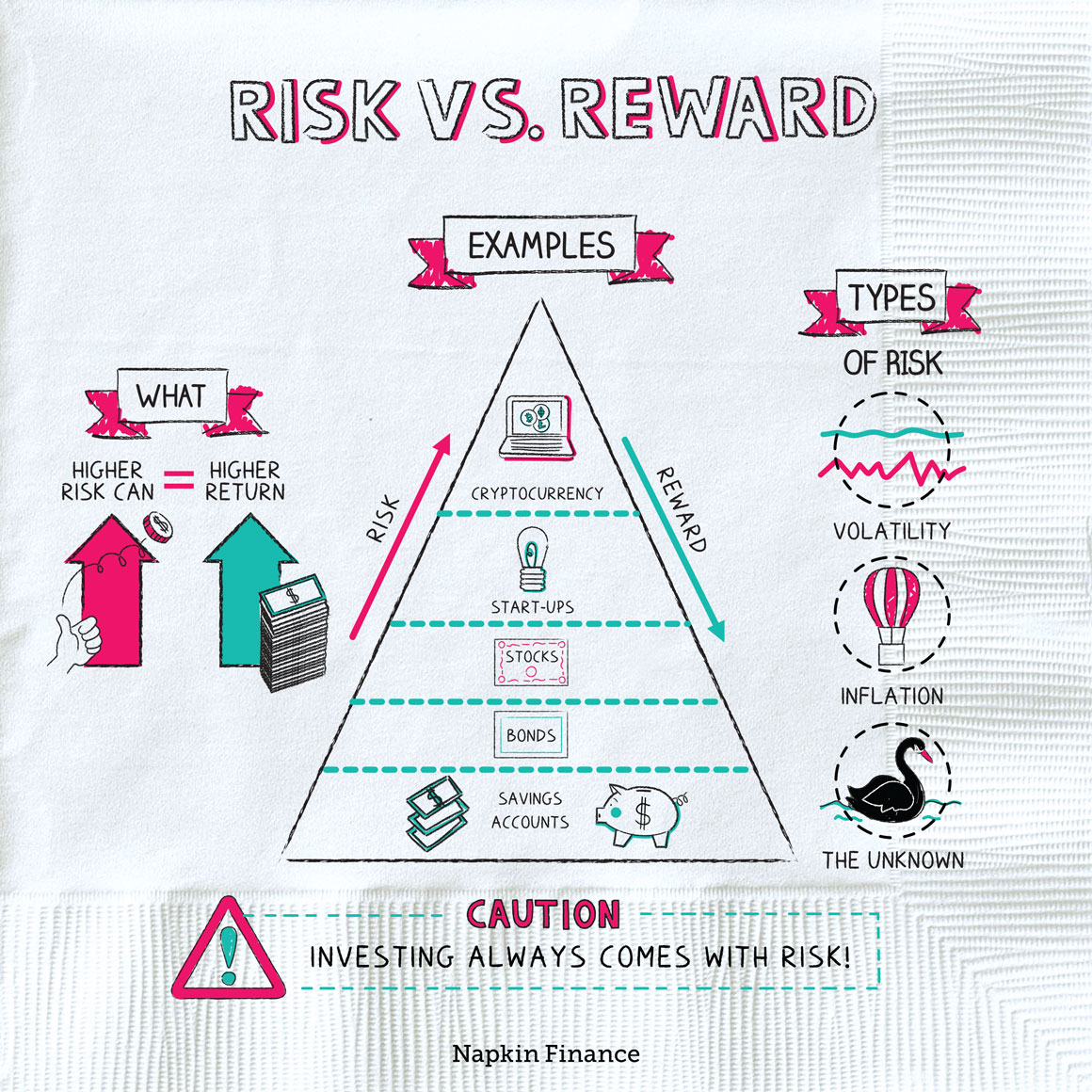

Investing is often portrayed as a complex and daunting endeavor, but at its core, it's about balancing risk and reward. The fundamental principle is simple: the higher the potential reward, the greater the risk you need to be prepared to take. However, successfully navigating this balance requires more than just understanding the basic concept. It requires a deep dive into your own risk tolerance, a thorough analysis of different investment options, and a strategic approach to managing potential downsides. Many new investors stumble by chasing high returns without fully understanding the risks involved, or by being overly conservative and missing out on opportunities for growth. This article aims to provide a comprehensive guide to understanding risk and reward, empowering you to make informed investment decisions.

Understanding Your Risk Tolerance

Before you even think about where to put your money, you need to understand yourself. Risk tolerance isn't just about your gut feeling; it's a complex mix of your financial situation, investment goals, and emotional capacity to handle market volatility.

- Assess Your Financial Situation: What's your income? What are your expenses? Do you have any debt? A strong financial foundation allows you to take on more risk because you have a safety net. If you're living paycheck to paycheck, investing in highly volatile assets might not be the best strategy.

- Define Your Investment Goals: Are you saving for retirement in 30 years, or do you need the money in five for a down payment on a house? Your timeline significantly impacts your risk tolerance. Longer timelines typically allow for greater risk because you have more time to recover from potential losses.

- Evaluate Your Emotional Capacity: How do you react when your investments lose value? Do you panic and sell, or do you stay calm and ride it out? Honestly assess your emotional response to market fluctuations. If you're prone to anxiety, consider less volatile investments. Think of it like this, friends: If seeing red arrows in your portfolio makes you break out in hives, maybe stay away from the really spicy investments.

Types of Investment Risks

Not all risks are created equal. Understanding the different types of risks is crucial for making informed investment decisions. Here's a breakdown of some common risks:

- Market Risk: This is the risk that the overall market will decline, impacting the value of your investments. Economic downturns, geopolitical events, and changes in investor sentiment can all contribute to market risk.

- Inflation Risk: This is the risk that inflation will erode the purchasing power of your returns. Even if your investments are growing, if inflation is rising faster, you're actually losing money in real terms.

- Interest Rate Risk: Changes in interest rates can impact the value of fixed-income investments like bonds. When interest rates rise, bond prices typically fall.

- Credit Risk: This is the risk that a borrower will default on their debt obligations. This is particularly relevant when investing in bonds, especially those issued by companies with lower credit ratings.

- Liquidity Risk: This is the risk that you won't be able to sell your investment quickly enough to prevent a loss. This can be a problem with less liquid assets like real estate or certain alternative investments. Imagine trying to sell a house during a recession - not a fun experience.

- Specific Risk (Unsystematic Risk): This risk is unique to a specific company or industry. Diversification can help mitigate specific risk. For example, if you invest all your money in one tech company and that company goes bankrupt, you lose everything. Spreading your investments across different sectors reduces this risk.

Assessing Potential Rewards

The potential reward is the return you expect to receive on your investment. This can come in the form of capital appreciation (an increase in the value of the asset), dividends (payments made by companies to their shareholders), or interest (payments made on bonds). However, it's essential to be realistic about potential rewards and not get caught up in hype or unrealistic expectations. Let’s discuss how to measure return:

- Historical Performance: While past performance is not a guarantee of future results, it can provide some insight into the potential returns of an investment. Look at the long-term track record and consider how the investment has performed during different market cycles.

- Industry Analysis: Understanding the industry in which a company operates can help you assess its growth potential. Is the industry growing or declining? What are the competitive dynamics? Are there any regulatory challenges?

- Company Fundamentals: If you're investing in stocks, analyze the company's financial statements, management team, and competitive position. Look for companies with strong earnings, healthy balance sheets, and a clear competitive advantage.

- Economic Outlook: The overall economic outlook can significantly impact investment returns. Factors like economic growth, inflation, and interest rates can all influence the performance of different asset classes.

Risk Management Strategies

Successfully balancing risk and reward requires a proactive approach to risk management. Here are some strategies to help you manage risk:

- Diversification: As mentioned earlier, diversification is a crucial risk management tool. Spreading your investments across different asset classes, industries, and geographic regions can help reduce your overall risk. Don't put all your eggs in one basket, friends!

- Asset Allocation: Asset allocation involves dividing your portfolio among different asset classes, such as stocks, bonds, and real estate. Your asset allocation should be based on your risk tolerance, investment goals, and time horizon.

- Dollar-Cost Averaging: This involves investing a fixed amount of money at regular intervals, regardless of the market price. This can help reduce the risk of investing a large sum of money at the wrong time. For instance, instead of investing $12,000 at once, invest $1,000 each month for a year.

- Stop-Loss Orders: A stop-loss order is an instruction to sell an investment if it falls below a certain price. This can help limit your losses in a declining market. Note, this is a tool best used by seasoned investors, as it can cause you to miss the rebound if the price later recovers.

- Rebalancing: Over time, your asset allocation may drift away from your target allocation due to market fluctuations. Rebalancing involves selling some assets that have performed well and buying assets that have underperformed to bring your portfolio back in line with your target allocation.

- Stay Informed: Keep up-to-date on market trends, economic developments, and company news. The more informed you are, the better equipped you'll be to make sound investment decisions.

Real-World Examples

Let's look at some real-world examples to illustrate the relationship between risk and reward:

- High-Growth Tech Stocks: These stocks have the potential for high returns, but they also come with significant risk. The tech industry is constantly evolving, and companies can quickly become obsolete. The dot-com bubble of the late 1990s is a prime example of the risks associated with investing in high-growth tech stocks.

- Bonds: Bonds are generally considered to be less risky than stocks, but they also offer lower potential returns. Government bonds are typically the safest type of bond, while corporate bonds offer higher yields but also carry more credit risk.

- Real Estate: Real estate can be a good investment, but it's also illiquid and subject to market fluctuations. The housing market crash of 2008 demonstrated the risks associated with investing in real estate.

- Cryptocurrencies: Cryptocurrencies like Bitcoin and Ethereum have the potential for very high returns, but they are also extremely volatile and speculative. The value of cryptocurrencies can fluctuate wildly, and there's a risk of losing your entire investment. In early 2024, Bitcoin reached new all-time highs, attracting both excitement and renewed concerns about its inherent volatility.

Future Trends and Predictions

The investment landscape is constantly evolving, and it's important to stay ahead of the curve. Here are some future trends and predictions to consider:

- Increased Focus on Sustainable Investing: Environmental, social, and governance (ESG) factors are becoming increasingly important to investors. Companies that prioritize sustainability are likely to outperform in the long run.

- Rise of Alternative Investments: As traditional asset classes become more expensive, investors are increasingly turning to alternative investments like private equity, hedge funds, and real estate to generate higher returns.

- Technological Disruption: Technology is disrupting virtually every industry, and the investment industry is no exception. Artificial intelligence, blockchain, and other technologies are transforming the way we invest.

- Increased Volatility: Global economic uncertainty, geopolitical tensions, and rising interest rates are likely to contribute to increased market volatility in the coming years.

In conclusion, understanding risk and reward is essential for successful investing. By assessing your risk tolerance, understanding different types of risks, and implementing effective risk management strategies, you can increase your chances of achieving your financial goals. Remember to stay informed, be patient, and don't let emotions drive your investment decisions. Happy investing!

Step Four:

Here are some frequently asked questions to help solidify your understanding of risk and reward in investing:

Question 1: What's the biggest mistake new investors make when it comes to risk and reward?

Answer: The biggest mistake is chasing high returns without fully understanding the risks involved. They often get caught up in hype or unrealistic expectations and fail to do their due diligence.

Question 2: How can I determine my personal risk tolerance?

Answer: Assess your financial situation, define your investment goals, and honestly evaluate your emotional capacity to handle market fluctuations. There are also online risk tolerance questionnaires that can help.

Question 3: Is it always better to invest in low-risk investments?

Answer: Not necessarily. While low-risk investments protect your capital, they may not provide enough returns to meet your financial goals, especially over the long term. The key is to find the right balance between risk and reward that aligns with your individual circumstances.

Question 4: What should I do if my investments start to lose money?

Answer: Don't panic! Resist the urge to make emotional decisions. Review your investment strategy, re-assess your risk tolerance, and consider rebalancing your portfolio. If you're unsure, seek advice from a qualified financial advisor.

Investing is a marathon, not a sprint, fellow investors.

We've journeyed through the landscape of risk and reward, highlighting the critical importance of understanding your own risk tolerance, identifying different types of investment risks, assessing potential rewards, and implementing effective risk management strategies. We've explored the necessity of diversification, asset allocation, and the benefits of staying informed. We've even delved into real-world examples and peered into future trends to equip you with a comprehensive understanding of this essential aspect of investing. The journey ends here, but it shouldn't be the end of your learning or the start of your implementation.

Now is the time to take what you've learned and apply it to your own investment journey. Take a hard look at your current portfolio, assess your risk tolerance, and develop a clear investment strategy aligned with your financial goals. Don't be afraid to seek professional advice if you need it. The goal is to take the knowledge that has been poured down here to improve you finiancial wellbeing.

The power to make informed investment decisions lies within you. Embrace the challenge, stay disciplined, and remember that even the most seasoned investors started somewhere. Now, go forth, and build a portfolio that aligns with your dreams and aspirations! Do you have any more questions about risk and reward that we can tackle together?