Unlock the Future: Tokenomics Strategies for Financial Analysts in 2025

Alright, friends, let's talk about something that's been buzzing around the financial world like a caffeinated bee – tokenomics. Now, if you're a financial analyst, chances are you've already dipped your toes into the crypto ocean. But let's be honest, navigating tokenomics can feel like trying to solve a Rubik's Cube blindfolded, especially with the crypto landscape evolving faster than a Shiba Inu chasing a laser pointer.

Ever wonder why some crypto projects explode in value while others fizzle out faster than a cheap firework? The secret sauce often lies in their tokenomics – the economic model that governs how a token is created, distributed, and used. It's the heartbeat of any crypto project, dictating its long-term sustainability and value proposition.

Think of it like this: Imagine you're running a lemonade stand. Tokenomics is your business plan. It's not just about selling lemonade; it's about how many lemons you buy, how much sugar you use, how you price your lemonade, and how you incentivize loyal customers (maybe with a "buy 10, get one free" punch card). A poorly designed tokenomic model is like running out of lemons on a hot day – it's going to leave a sour taste in everyone's mouth.

And here's the kicker: by 2025, tokenomics will be even more crucial. We're talking about a world where decentralized finance (De Fi) is no longer a niche corner of the internet but a mainstream force, where blockchain technology is integrated into everything from supply chain management to voting systems. As financial analysts, we need to be prepared to dissect these complex token economies, understand their strengths and weaknesses, and advise our clients accordingly.

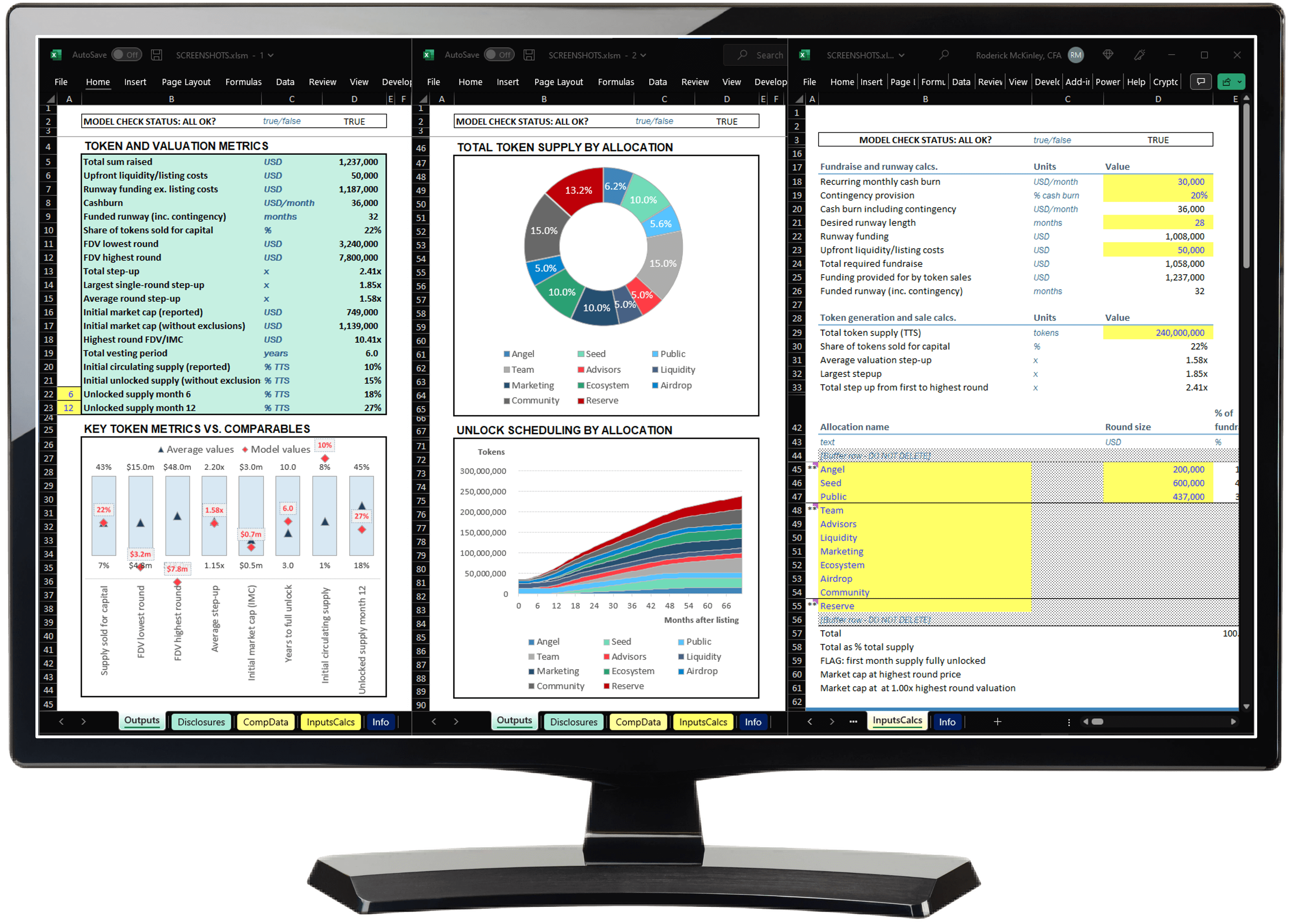

Now, I know what you might be thinking: "Tokenomics? That sounds complicated." And you're not wrong. There are vesting schedules, inflation rates, burning mechanisms, staking rewards, and governance protocols – it's enough to make your head spin faster than a De Fi yield farmer. But fear not, my friends! We're here to break it down, simplify the complex, and equip you with the knowledge you need to thrive in the tokenomic jungle.

So, are you ready to level up your tokenomics game? Are you curious to know the secrets that separate the winning crypto projects from the ones that crash and burn? Stick around, because we're about to dive into the top 6 tokenomics tips that every financial analyst needs to master by 2025. Get ready to unlock the future of finance!

Top 6 Tokenomics Tips for Financial Analysts in 2025

Alright, let's get down to brass tacks. Here are the top 6 tokenomics tips that will keep you ahead of the curve in 2025. These aren't just theoretical concepts; they're practical strategies you can use to analyze crypto projects, assess their potential, and advise your clients with confidence.

-

Master the Art of Supply and Demand Analysis

Friends, this is Tokenomics 101, but it's so crucial that we have to start here. It's not just about understanding how many tokens are in circulation; it's about understanding how those tokens are distributed and how that distribution affects their scarcity and desirability.

Think of it like this: Bitcoin has a limited supply of 21 million tokens. This scarcity is a major driver of its value. Now, imagine a token with an unlimited supply and constant inflation. What do you think will happen to its price? Probably not going to the moon, right?

Here's what to look for:

- Total Supply vs. Circulating Supply: Understand the difference. A large total supply with a small circulating supply can create inflationary pressure down the line as more tokens are released.

- Token Distribution: Is it concentrated in the hands of a few whales, or is it more evenly distributed among the community? A concentrated supply can lead to price manipulation.

- Inflation Rate: How quickly are new tokens being created? A high inflation rate can devalue existing tokens.

- Burning Mechanisms: Are there mechanisms in place to reduce the total supply over time, such as burning tokens used for transaction fees? This can increase scarcity and drive up price.

Real-World Example: Consider a project that airdrops a large portion of its tokens to early adopters. While this can create initial excitement, it can also lead to a "dump" when those early adopters cash out their free tokens. A sustainable project will have a well-planned distribution strategy that incentivizes long-term holding and participation.

-

Dive Deep into Utility: What Problem Does the Token Solve?

Let's be real, friends. In the Wild West days of crypto, many projects launched tokens with little or no actual utility. They were just riding the hype train. But those days are (mostly) over. In 2025, utility will be king.

A token's utility is its reason for existence. What problem does it solve? What value does it provide to users? Is it used for governance, staking, accessing specific features, or paying transaction fees? A strong utility creates demand for the token, which in turn drives up its value.

Here's how to assess a token's utility:

- Identify the Core Use Case: What is the primary purpose of the token? Be specific.

- Evaluate the Demand for that Use Case: Is there a real need for the service or product that the token enables?

- Assess the Token's Role in the Ecosystem: Is the token essential to the functioning of the platform, or is it just an afterthought?

- Consider Alternative Solutions: Could the same problem be solved without a token? If so, the token's utility is questionable.

Real-World Example: Chainlink's LINK token is used to pay node operators for providing data to smart contracts. The increasing demand for reliable data feeds in De Fi has driven up the demand for LINK, making it a valuable and essential part of the Chainlink ecosystem. Without LINK, the whole system falls apart. That's strong utility.

-

Understand Vesting Schedules and Lock-Up Periods

Okay, friends, let's talk about something that can make or break a project: vesting schedules and lock-up periods. These mechanisms are designed to prevent early investors and team members from dumping their tokens on the market immediately after launch, which can crash the price and destroy investor confidence.

A vesting schedule is a timeline over which tokens are gradually released to holders. A lock-up period is a period of time during which tokens cannot be traded or transferred.

Here's what to look for:

- Vesting Period Length: A longer vesting period is generally better, as it aligns the interests of early investors with the long-term success of the project.

- Vesting Schedule Structure: Is it linear vesting (tokens released at a constant rate over time) or cliff vesting (a large chunk of tokens released at a specific date)? Cliff vesting can create downward pressure on the price when the cliff date arrives.

- Lock-Up Periods for Team Members and Advisors: Make sure that the team is committed to the project for the long haul. Look for extended lock-up periods for founders, developers, and advisors.

Real-World Example: A project that releases a large percentage of its tokens to the team within the first year is a red flag. It suggests that the team is more interested in making a quick profit than building a sustainable ecosystem. A project with a well-structured vesting schedule and long lock-up periods demonstrates a commitment to long-term growth.

-

Analyze Governance Mechanisms: Who Controls the Future?

Friends, in the world of decentralized finance, governance is everything. It's about who gets to make the decisions that shape the future of the project. A well-designed governance mechanism ensures that the community has a voice and that the project is not controlled by a small group of individuals.

Governance tokens allow holders to participate in voting on proposals, suggesting changes to the protocol, and influencing the direction of the project. The more tokens you hold, the more voting power you have (in most cases).

Here's what to consider:

- Token Holder Voting Rights: What decisions can token holders vote on? Are they limited to minor changes, or can they influence major strategic decisions?

- Voting Thresholds: How many tokens are required to submit a proposal or to pass a vote? A low threshold can lead to spam proposals, while a high threshold can stifle innovation.

- Delegated Governance: Can token holders delegate their voting power to other users? This can improve voter participation and allow experts to represent the community.

- Transparency and Accountability: Is the governance process transparent and accountable? Are voting records publicly available?

Real-World Example: Maker DAO's MKR token is used to govern the Maker protocol, which issues the DAI stablecoin. MKR holders vote on everything from the stability fee (interest rate) for DAI to the addition of new collateral types. This decentralized governance mechanism is a key reason for Maker DAO's success and resilience.

-

Evaluate Staking and Reward Systems: Incentives Matter

Alright, friends, let's talk about staking. It's like putting your crypto to work and earning rewards for it. Staking involves locking up your tokens to support the network and, in return, receiving additional tokens as a reward. It's a powerful way to incentivize long-term holding and participation.

Here's what to look for:

- Staking Rewards Rate: How much can you earn by staking your tokens? A high rewards rate can be attractive, but it can also be unsustainable if it leads to excessive inflation.

- Lock-Up Periods for Staking: Are there lock-up periods for staking? A longer lock-up period can reduce the circulating supply and stabilize the price.

- Staking Requirements: Are there minimum staking requirements? This can exclude smaller token holders from participating.

- Impact on Token Supply: Does staking reduce the circulating supply? If so, it can create scarcity and drive up price.

Real-World Example: Ethereum's move to Proof-of-Stake (Po S) with ETH2.0 allows users to stake their ETH to validate transactions and earn rewards. This has significantly reduced the circulating supply of ETH and is expected to make the network more secure and energy-efficient.

-

Stay Updated on Regulatory Trends: Compliance is Key

Friends, this is a big one. As crypto becomes more mainstream, regulatory scrutiny is only going to increase. In 2025, compliance will be essential for any successful crypto project. As financial analysts, we need to understand the regulatory landscape and advise our clients accordingly.

Here's what to stay informed about:

- Securities Laws: Are tokens classified as securities? If so, they may be subject to strict regulations.

- Anti-Money Laundering (AML) Regulations: Are projects complying with AML regulations? This is crucial for preventing illicit activity.

- Tax Laws: How are tokens taxed in different jurisdictions? This can have a significant impact on investor returns.

- Central Bank Digital Currencies (CBDCs): How will CBDCs impact the crypto market? They could be a competitor or a complement to existing cryptocurrencies.

Real-World Example: Projects that fail to comply with securities laws or AML regulations risk facing hefty fines or even being shut down. A project that proactively engages with regulators and demonstrates a commitment to compliance is more likely to succeed in the long run.

Questions and Answers

Alright, let's tackle some common questions about tokenomics. These are the questions your clients will be asking, so you need to be prepared to answer them.

Q: What's the difference between a token and a coin?

A: This is a classic question! A coin is a cryptocurrency that has its own blockchain (like Bitcoin or Litecoin). A token, on the other hand, is built on top of an existing blockchain (like Ethereum or Binance Smart Chain). Think of coins as the foundation and tokens as the buildings on top of that foundation.

Q: How can I tell if a token is a scam?

A: Red flags for a potential scam include a team that is anonymous or lacks experience, unrealistic promises of high returns, a poorly written whitepaper, and a lack of transparency. Always do your own research and be skeptical of anything that sounds too good to be true.

Q: What is "token burning" and why do projects do it?

A: Token burning is the process of permanently removing tokens from circulation. Projects do it to reduce the total supply of tokens, which can increase scarcity and drive up the price. It's like a company buying back its own stock to boost its share price.

Q: How important is community engagement in a token's success?

A: Community engagement is crucial! A strong and active community can help promote the project, provide feedback, and contribute to its development. A project with a vibrant community is more likely to be successful in the long run.

Alright, friends, we've covered a lot of ground. You now have the knowledge you need to navigate the complex world of tokenomics and advise your clients with confidence. Remember, the key is to stay informed, do your own research, and be skeptical of anything that sounds too good to be true.

So, friends, what now? We've journeyed through the intricate maze of tokenomics, equipping you with the essential tools and insights to excel as a financial analyst in 2025. You're now armed with the knowledge to dissect token economies, understand their underlying mechanisms, and make informed decisions that can shape the future of finance. But knowledge without action is like a ship without a sail.

The core of our discussion revolved around mastering supply and demand, understanding token utility, analyzing vesting schedules, scrutinizing governance mechanisms, evaluating staking rewards, and staying abreast of regulatory trends. These are not just buzzwords; they are the pillars upon which successful tokenomic models are built. By integrating these strategies into your analytical toolkit, you'll be well-prepared to navigate the ever-evolving crypto landscape.

Now, let's translate this knowledge into tangible action. Here's your call to action: Take what you've learned today and apply it to your next crypto project analysis. Don't just skim the surface; dive deep into the tokenomics, ask critical questions, and challenge assumptions. Share your findings with your colleagues, engage in constructive discussions, and contribute to the collective understanding of this fascinating field.

The world of tokenomics is constantly evolving, and the only way to stay ahead of the curve is to be proactive, curious, and willing to learn. Embrace the challenge, seek out new knowledge, and never stop questioning. The future of finance is being built today, and you have the opportunity to be a part of it.

So, go forth and conquer the tokenomic landscape! Your expertise is needed to guide investors, shape projects, and build a more sustainable and equitable financial future. Remember, the journey of a thousand miles begins with a single step. What's your first step going to be?